Why F&G Life?

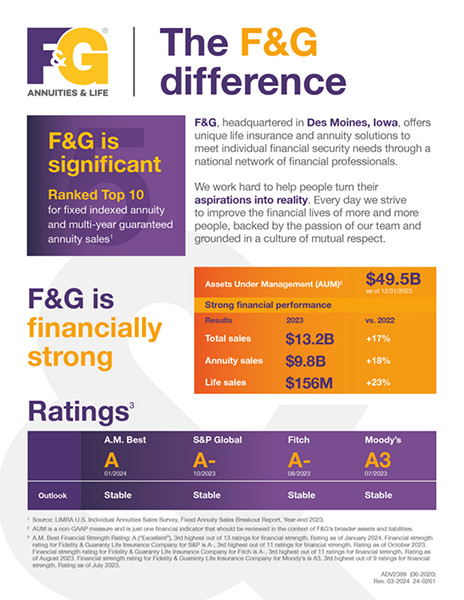

For over 60 years, F&G has built a growing business based on partnership, innovation and a disciplined approach. We are supporting our vision of improving the financial lives of more, and are ranked #3 in fixed indexed universal life (FIUL) policy count1.

-

We are Financially Strong: A Rating with A.M. Best, A- ratings with S&P Global and Fitch Ratings and A3 with Moody's

View full ratings2 -

Our Strong FIUL product performance is driven by high cap and par rates and a reliable rate history

-

F&G offers a streamlined online application process and Exam-Free3 Underwriting, along with accelerated death benefits for Critical, Chronic and Terminal illness

What is Fixed Indexed Universal Life Insurance?

FIUL insurance is permanent life insurance with policy performance tied to a market-driven index. This allows policy cash values to grow with market indexes while the guaranteed product floor protects against market index loss. F&G FIUL products provide lifelong flexible protection with strong cash accumulation potential and play an important part in creating a secure financial plan.

Explore individual products:

Explore our Living Benefits Case Studies

Read in-depth about Jeffrey, Mary, and Sue and what life insurance for the living looks like.

Attend F&G Live Webinars

Join us for informative live sessions featuring content designed to help you grow your business. The sessions, led by your Dedicated Life Sales Support Team, will be held weekly.

Browse Upcoming WebinarsVisit our F&G Life Agent Training Center

Find help with case designs and illustrations, improve your understanding of FIULs, and deep dive into our tools.

Explore Training Center“F&G” is the marketing name for Fidelity & Guaranty Life Insurance Company issuing insurance in the United States outside of New York. Life insurance and annuities issued by Fidelity & Guaranty Life Insurance Company, Des Moines, IA.

ADV 2489 (Nov-2020)Rev. 01-2024 24-0096

1LIMRA YTD Q1, 2023 U.S. Retail Individual Life Sales Reports

2 AM Best Financial Strength Rating: A (“Excellent”), 3rd highest out of 13 ratings for financial strength. Rating as of January 2024. Financial strength rating for Fidelity & Guaranty Life Insurance Company for S&P is A-, 3rd highest out of 11 ratings for financial strength. Rating as of October 2023. Financial strength rating for Fidelity & Guaranty Life Insurance Company for Fitch is A-, 3rd highest out of 11 ratings for financial strength. Rating as of August 2023. Financial strength rating for Fidelity & Guaranty Life Insurance Company for Moody’s is A3, third highest out of 9 ratings for financial strength. Rating as of July 2023.

3 Policy approval is determined by a review of medical and personal history on the application and may be subject to additional underwriting requirements at the discretion of F&G. Review Fidelity & Guaranty Life Insurance Company Underwriting Guidelines for additional details. For applicants who are not U.S. citizens or not permanent resident cardholders, the maximum issue face amount for exam-free underwriting is $300,000. In Puerto Rico, exam-free underwriting is available for applicants age 0-45 who are applying for less than $150,000.